Calculate the potential risk using the liquidation table. To do this, set the parameters with which the bot will be run in the special fields highlighted in purple.

Use this method to understand how the averaging will go and what price move is necessary to close a position in the plus side. The table displays information ranging from volume to the balance of the unused deposit.

Use the following instructions as a guide:

1. To start editing, duplicate the Google Spreadsheet to your Drive.

Click File > Create Copy.

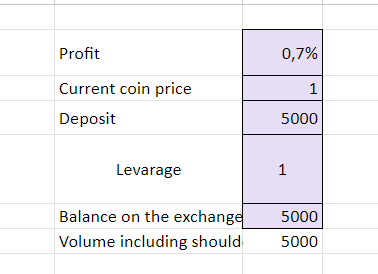

2. On the right side of the table, set the current coin price, deposit amount, margin, desired take profit (type in along with the % number for proper calculation) and leverage.

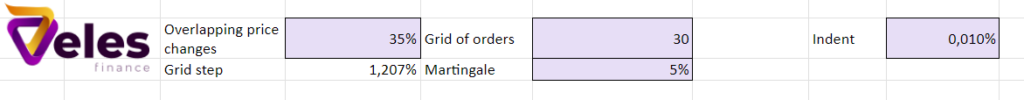

3. Set the price overlap. This function will determine by how many percent the grid of orders will be arranged. Do not forget to set the % symbol in the field.

4. In the Grid of orders, set the number of buy or sell orders with which the bot will be launched.

5. Set the Martingale percentage, which is used for optimal averaging based on your trading strategy. Write the % at the end of the number for proper calculation.

6. Set the indent at which the first order will be placed in the grid. The entire bot grid will start below or above (depending on long/short) the current price by the set percentage.

7. Leave the Commission field untouched if you are using the Binance exchange for trading. If you are trading on another exchange, set your own values based on the rules of the exchange.

We have highlighted the priority data in the columns of the table in bold:

- Order volume allows you to find out how much money will be involved in the order, taking into account leverage.

- Order Execution Price is the quote at which the buy (long) or sell (short) order will be executed.

- PnL is the drawdown of the position at the moment of averaging.

- The exit price shows the value of the asset to close the position with a profit.

- Positive PnL calculates the profit from a trade according to the profit percentage and the specified leverage.

- Growth Percentage calculates the necessary price move to close a position in plus.

- Liquidation shows the order at which the position will be completely closed without utilizing the entire grid, this is due to the lack of margin for leverage.

- Liquidation will occur at the asset price – this is the asset price at which the position will be completely closed with a loss.

Please note that the table does not take into account the Veles commission when closing a plus trade. Veles commission is 20% of the profit, but no more than $50 per month.