A Stop Loss by an indicator signal is a protective function that closes a deal at a loss by a market order, and is activated when two conditions are met:

- The preset filter/indicator signals are received;

- The specified minimum indent is reached

– either from the last order in the grid, if it is set. If the minimum indent parameter is disabled, then only the signal is taken into account.

– or from the average deal price.

We remind you that a simple Stop Loss is triggered when a fixed price is reached (calculated based on a given percentage of the price move from the last order in the grid):

https://help.veles.finance/en/stop-loss/

How does it work?

The bot receives a signal, for example, about a trend change (crossing the level of the Bollinger Bands or a decrease in the RSI below a critical level), or a signal about a volume change in the asset, or increased volatility is recorded, and so on.

The indicator signals for Stop Loss are interpreted according to the same logic as in the group of indicators for the start of the deal. That is, for a long bot, the Bollinger Bands for a Stop Loss will trigger when the price breaks through the lower border of the channel (just as it is necessary to open a deal in Long).

The bot then checks how much the current price is lower than either the price of the last grid order or the average deal price. If the margin is met (or verification is disabled), then a market order is placed on the exchange, closing the deal.

Important! All market orders are subject to slippage, so the price at the time of placing the order and the price at its execution may not match.

Note. Simple Stop Loss and Stop Loss by an indicator signal work independently of each other. Whichever condition is fulfilled earlier, that Stop Loss is triggered.

How to apply it in trading?

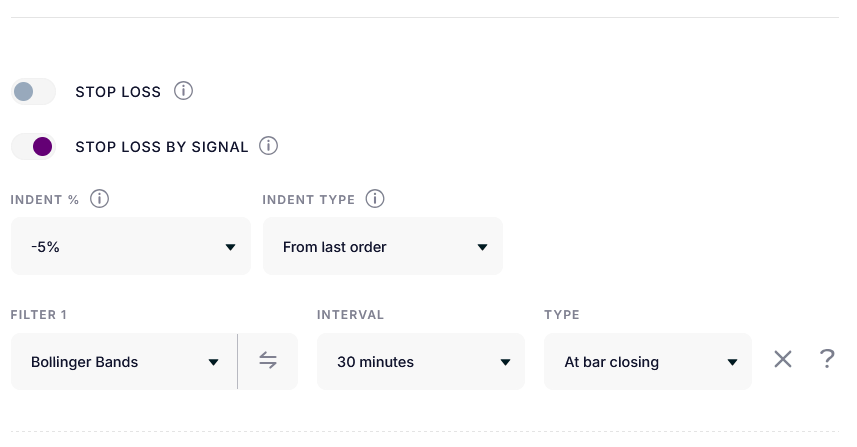

1. Enable the “Stop by Signal” function in the editor.

2. Set the necessary parameters for automatic deal closing in the settings – minimal indent (%), indent type and the filters.

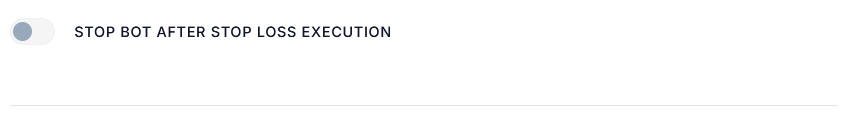

3. Specify whether to stop the bot after executing the Stop Loss.

Example 1

There are 3 orders in the bot’s grid,

the Stop Loss filter is 30 minutes of Bollinger Bands,

the minimum Stop Loss margin from the last order is 5%.

The Stop Loss was placed on the exchange when all orders were executed, the price broke through the channel boundary, and the minimum indent from the last order exceeded 5%.

Example 2

There are 3 orders in the bot’s grid,

the Stop Loss filter is 30 minutes of Bollinger Bands,

the minimum Stop Loss margin from the average price is 5%.

A Stop Loss was placed on the exchange when the price broke through the channel boundary, and the minimum indent from the average price exceeded 5%.