It is very important to determine the safe size of the deposit that will be used in trading. A common mistake of beginners is to overestimate the amount allocated to the bot, as a result of which there is a rapid loss of funds due to the liquidation of its position.

Depending on the type of margin used on the trading account, different recommendations are used.

If you are trading on an Isolated margin, then the amount of liquidation losses (which is approximately equal to the bot’s deposit in this case) should not exceed 1% of the trading account balance.

The same rule applies to bots on Cross margin with a Stop Loss. The estimated amount of Stop Loss losses must be determined in advance (use the TradingView window in the bot editor or backtests), and it should not be higher than 1% of the trading account balance.

If you trade on a Cross margin without a Stop Loss, the calculations will be a little more difficult:

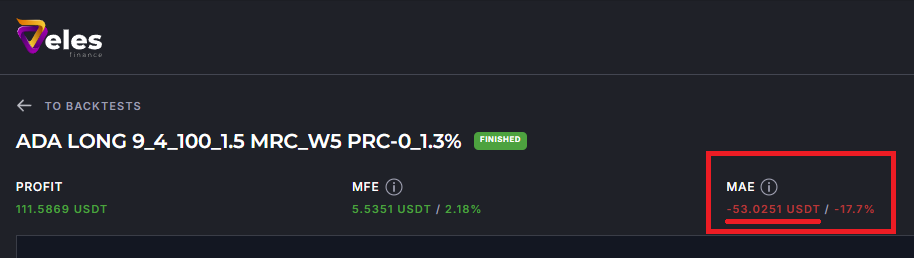

1. Run a backtest for your bot for the maximum period available to you and look at its MAE (Maximum Adverse Excursion). The period must necessarily include episodes of market drawdowns. Therefore, ideally, it should be a one-year backtest.

How to run a backtest correctly and read its results is described in our article:

https://help.veles.finance/en/backtests/

2. If the MAE is less than the bot’s deposit, then keep an amount equal to the Deposit*2 on the trading account for this bot.

If the MAE is greater than the bot’s deposit, then keep an amount equal to MAE*2 in the trading account.

3. If you have several bots, their deposit/leverage ratios should be such that the sum of all MAEs is 2 times less than the balance of the trading account.

In general, we strongly recommend setting up a deposit/leverage ratio in strategies in which the MAE will be less than the deposit allocated to the bot.

Even in this case, we recommend to allocatе 5-10 bots per subaccount and regularly transfer the earned profits to other accounts. This profit can either be given to new bots on new trading accounts/exchanges, or it can be spent on other purposes.

For example:

Bot 1:

deposit 100 USDT, leverage is not important, the annual backtest showed a MAE of -115 USDT.

Bot 2:

deposit 100 USDT, leverage is not important, the annual backtest showed a MAE of -130 USDT.

Bot 3:

deposit 100 USDT, leverage is not important, the annual backtest showed a MAE of -50 USDT (excellent, congratulations! in this case, we just take a deposit=100 for the calculation)

The recommended trading account balance for running these three bots on a cross margin will be equal to:

2 * (115+130+100)=2 * 345 = 690 USDT.

If you do not know which trading pair to choose, we can recommend using fundamental coins such as BTC and ETH in trading, or trading only coins from the Top 20 coinmarketcap.com.

How can you lower the MAE:

- lower your leverage in the bot;

- increase the “% Overlap” parameter;

- increase the “% Martingale” parameter;

- lower the “Logarithmic distribution” parameter;

- add indicators on higher timeframes as input;

- use averaging based on indicator signals (https://help.veles.finance/en/trading-mode-signal/), so the bot will not execute the grid orders in the drawdowns, but only after the price reverse, for example;

- use a check in the bot (for example, “Percent of price change“) that will not allow opening a deal after a recent pump (trading Long) or dump (trading Short).

We do not recommend to use small Overlap % values (https://help.veles.finance/en/how-to-create-and-edit-a-bot-full-list-of-bot-settings/). Study the chart of a particular coin and its behavior during periods of market drawdown in order to choose the optimal working percentage of the price move.

Use effective filters to select the entry point to the deal (the creating of the opening order):

https://help.veles.finance/en/what-are-bot-filters/

It is absolutely possible to earn money in algotrading, it is real. But here, as in ordinary mathematics, success at a distance consists of specific components.

To get a total of 5, you need to add 2 and 3, or 1 and 4, or 2 and 2 and 1. If you changed one term, compensate for it in the other.

- If you run a high-risk strategy with a short grid (up to 10% overlap), allocate a minimum of funds for it, the rest of the balance will act as supporting margin, it should not be given to other bots! And get ready for long-term invests. The backtest will show you how to calculate the balance for the bot and how long the invests may be.

Consider also using in this strategy a protection against opening deal in Long after recent growth (or deal in Short after a recent sharp drop in price). Combinations of oscillators or the “% price change” filter on different timeframes at once can help you here. - If you launch a high-risk strategy with almost no supporting margin, allocate a separate subaccount to it, from where you regularly withdraw profits so that only this balance can be lost in the market drawdown (which inevitably happens).

- If your bot uses a high Martingale percentage and a wide grid, be prepared for the fact that it usually makes a modest profit. But at times of drawdowns in the market, when the positions of other traders are massively liquidated, it successfully closes its deal. After that, it continues to make profits, while those affected by the liquidation take a break from trading.

- If you are launching a strategy with rare entry points, be prepared for the fact that the bot is waiting for a signal almost all the time. But you can create many such strategies for different coins and limit the number of deals opened at the same time:

https://help.veles.finance/en/limiting-the-number-of-bots-in-a-deal/ - If you run a bot without filters, this is also possible, but for its successful operation you need a high Martingale, not a short grid and a solid deposit.

To summarize, do not rush to risk your funds by launching strategies at random without understanding. The market will always move, and there will always be something to catch on it. We provide support and tools to ensure that you are thoroughly prepared and can participate in this exciting process with minimal risk. Invest your time first (it won’t take much), and only then – your money, and only then the result will please us all!

If there are any unclear points in this article, just sign up for our free consultation to get answers from our specialist:

https://calendly.com/velestechnicalsupport/15min