VELES FINANCE is a simple and convenient platform for creating bots for the cryptocurrency market. For people, who want to trade, but not to spend all their free time.

Our bots can connect either to a Spot or Futures trading account. On the Spot your bot trades coins (for example, we buy a coin after its price drops and sell the coin when the price rises), and on Futures bot trades contracts for coins (that is, obligations to buy or sell it).

Exchanges, available for connection, are: Binance (Spot, Futures), BingX (Futures), Bitget (Futures), Bybit (Spot, Futures), Gate.io (Spot, Futures), HTX (Spot), OKX (Spot, Futures).

We recommend all beginners to start with trading on Spot, it is easier to understand and safer.

* The connection of Kucoin exchange to our platform is currently under development.

How does Veles bot work?

The bot monitors the exchange 24/7 and according to the technical analysis indicators that you specified, it will open deals, average and close them – at any time of the day, without your participation.

One bot can be configured to trade either in Long or Short algorithm.

Successful deal (or trade, or transaction) looks like “Buy when it’s cheap – sell when it’s expensive” (trading algorithm Long). Or in the opposite direction: “Sell when it’s expensive – buy it back when it gets cheaper” (trading algorithm Short).

To make a deal on the exchange, you need to place a group of relevant orders. First, these will be orders to open a deal, then orders to close it. When all orders (both opening and closing) are executed in full, for the entire planned volume, the deal is completed.

An ordinary trader selects an asset to trade, determines the desired price and amount of the asset to buy (or sell), creates the appropriate order manually through a dialog box on the exchange and waits for its execution. He must also take care of the proper closing of deals – sell (or vice versa, buy) an asset with a profit, or with an acceptable loss (if the deal did not go according to plan). To do this, trader must place separate orders on the exchange. And we also add that the asset can be purchased in parts, and sold in parts – for all these actions, separate orders are needed, placed on time…

And all this can be entrusted to exchange bots today. You create a strategy in advance, flexibly define a set of conditions for entering, running, and exiting a deal. Then you test your strategy on a simulator (“Analysis”, or backtest). And only then – when everything is fine – you release your bot to a real trading account. The bot creates a set of orders according to your settings (what and for how much to buy and sell), and places these orders on the exchange, connecting to it using special keys that you create for it. That is, a bot on the exchange is determined only by its work – orders and the results of their execution.

Our little minions can work with both a single order and a grid, according to the Martingale strategy. Does it sound complicated? Don’t worry, we’ll try to explain everything in simple words! Bots closely monitor their indicators (these are special parameters calculated using formulas) in the cryptocurrency market. And if the indicators are triggered (for example, they are configured to show a drop in the price of a particular coin), bot buys off this downward movement. This is where the strategy begins to work: the bot calculates the volume of each next order so that it is higher than the previous one. This is called “cost averaging“, and it allows you to reach the profit point before the price returns to the level where the current trade started.

Like in this deal:

This is a deal in a Long algorythm (we buy cheaper to sell it with profit). The bot bought contracts in 4 steps (placed orders “Buy 1”, “Buy 2”, “Buy 3”, “Buy 4”), and then sold all the contracts at once, with one closing order (Sale).

“Buy 1” is the first order, here the bot opened the deal. If the price had gone higher after that, the bot would have placed a “Sell” order and completed the deal. However, the price went down.

“Buy 2”, “Buy 3” – averaging orders with a gradual increase in volume. With the same logic as after the first order, if the price went up after any of them and reached the point where the profit condition was fulfilled, the bot would place a “Sell” order and close the deal.

“Buy 4” is an averaging order, after which the price also fell, but did not reach the “Buy 5” order, but turned around and reached the point for closing the deal. The bot placed a “Sell” order, and the deal was complete.

Please note that the opening order “Buy 1” was executed at a price higher than the one where the closing order “Sell” eventually took place. But thanks to cost averaging (orders “Buy 2”, “Buy 3”, “Buy 4”) we nevertheless made a profit of 1.39% of the invested deposit. This deal took 2 days.

The bot that run this deal created an averaging grid of 5 orders (these are orders from “Buy 1” to “Buy 5” placed at an Overlap of 15% of the price). But since the price did not fall by all 15%, it only reached the “Buy 4” order. Down to the lowest, fifth order, the price did not fall, the order in this deal was not executed, and it is not present in the picture. The bot first created and then deleted this order when it closed the deal, so it left a clean trading account (without forgotten orders), with one difference – slightly replenished.

Note. The bot’s orders belonging to the deal are visible on the exchange if the bot trades limit orders. If the bot is configured to average and to take profit based on indicator signals, then there are no orders on the exchange, but they will be placed as the market orders.

Why bots, not real people?

Well, first of all, the future has already come and it’s time for robots to work in our place. And secondly, bots work tirelessly 24/7 ― they automatically search for entry points in the market according to the filters you set. They save your money by keeping within the framework of a preconfigured strategy and the balance allocated for trading. But most importantly, bots save you time and earn money while you are busy with something more important.

They have no emotions, greed and fatigue, unlike humans, they are always calm and impartial. VELES bots will repeat the configured cycle day after day and will not leave the route.

How is Veles better than embedded exchange bots?

Veles bots have more flexibility and customization options compared to exchange bots.

A fixed GRID is most often used on the exchange. Veles implements a DCA approach with the ability to set individual margins, volumes, and conditions not only for entry, but also for averages, stop losses, and take profits. You also have access to backtests, simulating the trading of the bot you built.

This allows you to more accurately control the strategy and adapt it to the market.

And who will help you figure it out?

In case of problems by launching a bot or a backtest (trading simulator), explanations and recommendations for a solution are always at hand, this is the link “to Wiki” from the error message or the button ( i ) on the bot card.

And also at your service:

- detailed Wiki – our help system with search,

- educational videos on Youtube and at the Academy,

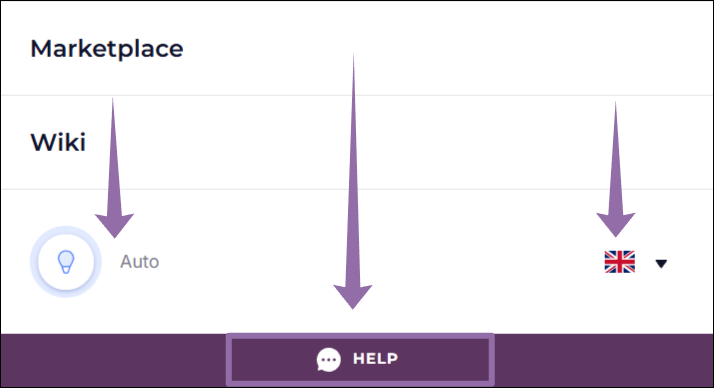

- the “Help” button in your personal account for a personal chat with Support (at the bottom right on a PC, or at the very bottom of the opened menu on a mobile device),,

- our project’s group in Telegram, for communication with Support or experienced users,

- a blog with lots of useful articles,

- and, of course, our free consultations.

What is Veles personal cabinet?

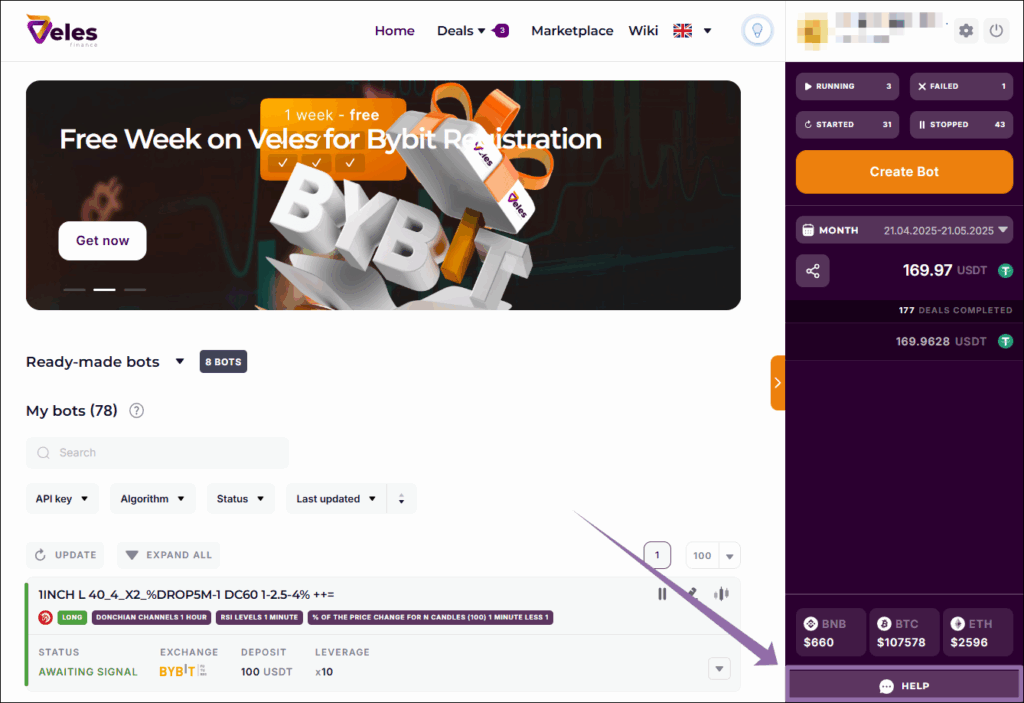

On the Veles cabinet main page you can see:

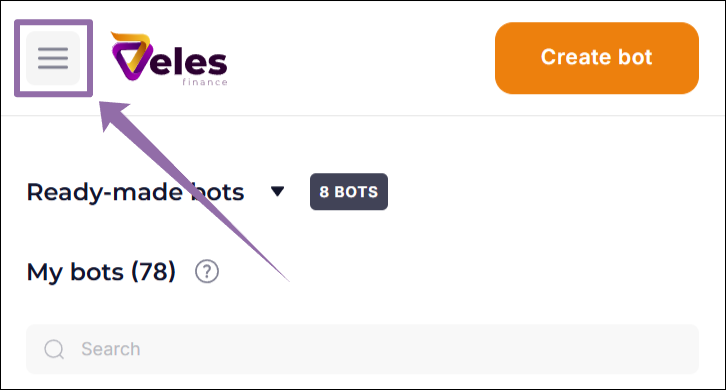

- the main menu for switching between cabinet sections (the top line on the PC or the “Three stripes” button on the mobile device on the top left),

- expandable statistics panel (on the right),

- “Ready-made bots” showcase,

- the “My bots” section.

The range of options to manage the cabinet is regularly expanded, increasing the reliability and convenience of the service.

The “Ready-made bots” showcase contains a set of training settings that you can copy, study, make a backtest and then run on the exchange, if you are satisfied with the test results. To see all your bots (if some of them are not visible), click the filter cleaning button (“Trash can” icon).

The “My bots” list contains cards for all the bots that you have saved. Over time, this list becomes very long, but you can conveniently manage it using customizable filters.

The “API key” filter works according to the “OR” logic, bots using any of the selected Bindings will be shown.

The “Algorithm” filter allows you to separate bots for the Long algorithm from bots for Short algorithm.

The “Status” filter allows you to select bots by all the statuses marked in the list.

You can also specify the sorting order in the list – “Date created” or “Last updated”, from old to new or vice versa.

Usually, not all of your bots are running the deals at the same time. To see all your current open deals (list of Active deal cards) you should switch to the Active Deals page.

We took on all the most difficult work and laid the necessary strategies in advance as the basis for the behavior of bots, and made a convenient template for you. All you have to do is choose a strategy to suit your needs ― conservative, moderate or aggressive. It will take you no more than 3 minutes to launch the finished template.

And if something is unclear, our Support is ready to answer your questions in the Telegram

– in our Community (please read all the pinned messages and sequrity warnings),

– in a direct chat (please contact us right now and save the Contact so you will not confuse us with scammers),

– by the Help button in your cabinet.

And on the mobile devices:

Pick the “Menu” button in the top left corner and scroll down to see the buttons: “Dark/Light” mode switch, “Help” and “Language”:

Read next:

Beware of scammers!

Common mistakes of beginners

or

Help Index