The Veles platform offers several options for closing a position, which are suitable for the most demanding trader with his trading strategy.

There are three ways to close your position. You can choose between a simple take profit, multi-takes and a signal take profit.

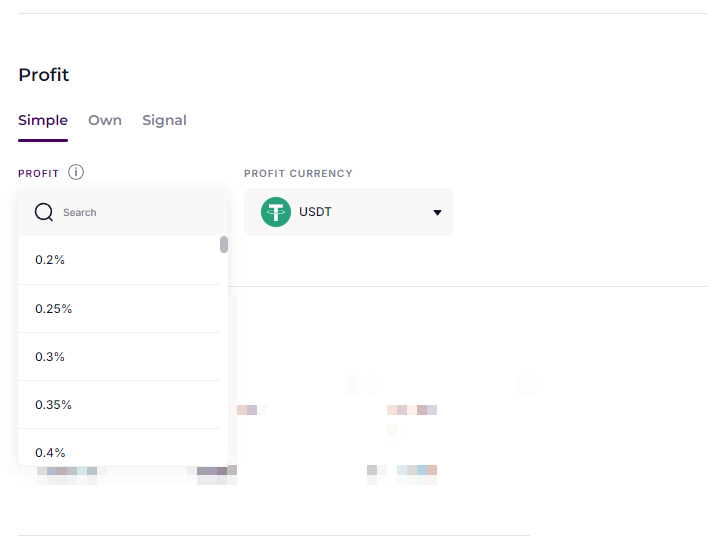

“Simple” Take Profit

This is a classic way to fix a profit in a deal.

Select the percent of profit above the average position price where you are going to close your deals.

When you choose a value of 0.5%, the bot places a limit order on the exchange, which will close your position as soon as the price will reach 0.5% of the average position price. Each time an averaging order is executed (grid or manually added), the bot deletes the old take profit order and creates a new one with the current price and volume.

On Binance, Bing, Bitget and OKX exchanges is also available the “Trailing Stop” as an option. Read more about this setting in our article:

https://help.veles.finance/en/trailing-stop/

When trading on the Spot, you can also choose the “Profit currency” – the bot can fix profits either in coin or in a stablecoin (in base currency or in quote currency):

https://help.veles.finance/en/currency-of-profit/

Attention! P&L on the exchange and P&L at Veles are different parameters in meaning, although they are called the same way. On Veles, this is a measure of the net price movement. On the exchange, P&L is taking into account the leverage. It turns out that 1% P&L on Veles is 10% P&L on the exchange with x10 leverage.

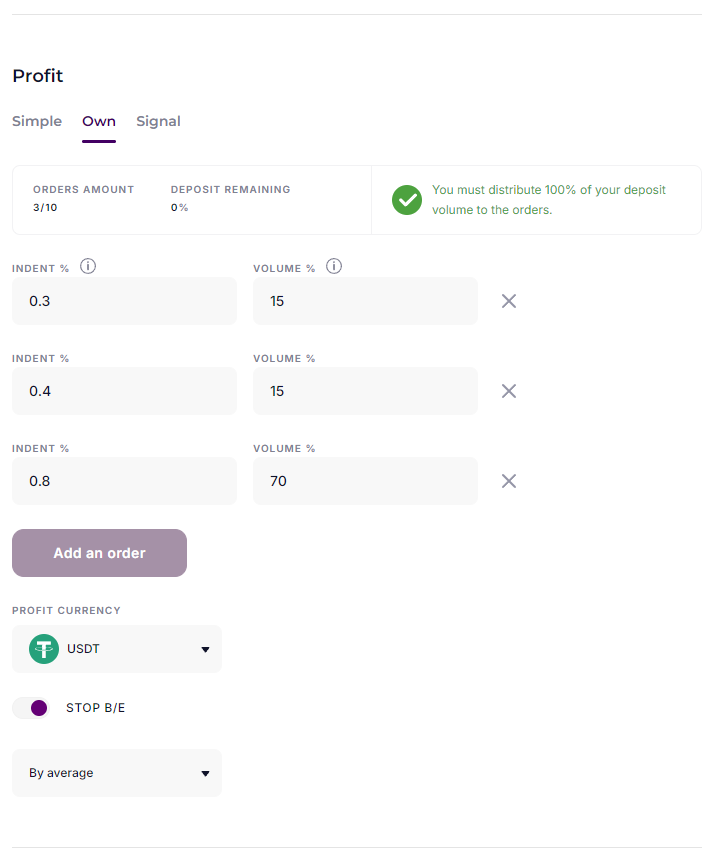

Multi-Takes (“Own”)

The multi-take option is a tool that allows you to close a position in parts.

After executing the first grid order to create a position, the system automatically calculates multi-take limit orders to close the position. In this case, only the first order is placed on the exchange, and the rest are added as the previous orders are executed.

Multitakes are also recalculated as the bot executes averaging orders.

When the first target is reached, part of the position will be closed in accordance with the set volume, the rest will be redistributed to other closing orders. Thanks to this method, the deal can be closed with a better profit.

In the “Profit” block, select the “Own” mode, add and configure orders, determine the target profit percent for each order and allocate the desired volume to it within the total amount of 100%.

This way you will unload the position in parts and secure your deposit in the event of a market reversal.

The “Indent %” sets the percent above your average position price to place an order.

“Volume %” sets the percent of the nominal value of the position by which part of it will be closed.

Here it is also possible to set the closure of the remaining position with a stoploss at breakeven – with a market order that will work either at the level of the average position price or at the level of an earlier take profit. Important information about this setting is collected in our article:

https://help.veles.finance/en/stop-loss-to-breakeven/

When trading on a Spot, in the “Profit currency” field, you can select the currency in which the profit will be calculated if case of success. However, this option will only work on Take Profit orders, but not on Stop Loss at breakeven:

https://help.veles.finance/en/currency-of-profit/

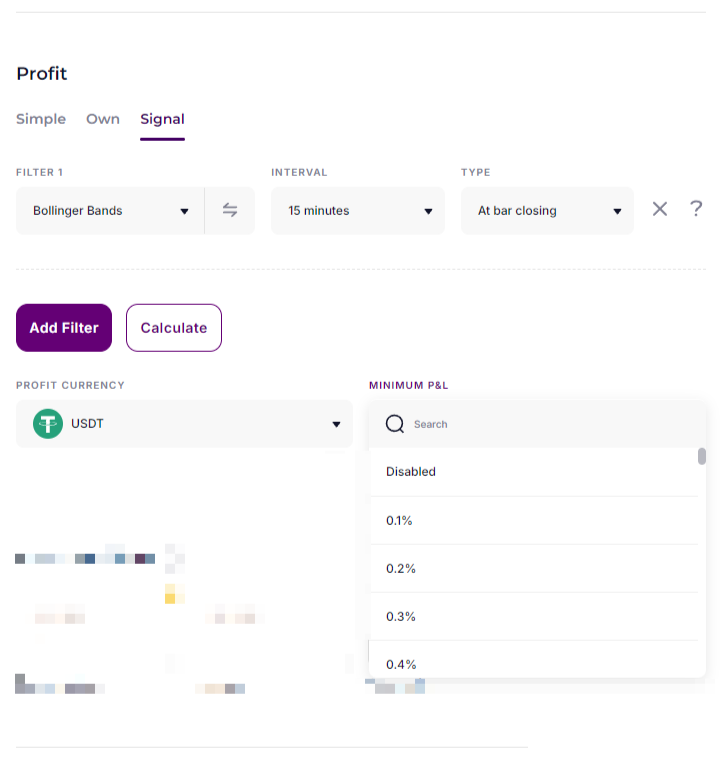

Closing a deal by Indicator (“Signal”)

With this option, the bot will automatically close the position when the indicator gives the appropriate signal.

For example, if you launched a bot into a Short and told it to close a position based on the Donchian Channel indicator, then the algorithms will automatically close the position as soon as the indicator sends an oversold signal.

Select the “Signal” tab in the “Profit” block.

You can select any available indicator or a combination of them for your own strategy.

To prevent the bot from closing a deal on the indicator signal while the PnL in this deal is less than desired, set the value from the list “Minimum P&L”.

Every time the bot receives an exit signal, the bot will check if the value of “Minimum P&L” is reached. And only when both conditions are met, the bot will close the position with a market order. The minimum value that can be specified as a profit is 0.1%.

When trading on a Spot, in this case, you will not be able to choose the “Profit Currency“. All profits will be received only in the quote currency (for example, in stablecoin) – for a Long bot, or in the base currency (in coin) – for a Short bot.