If the current PnL in your deal turned out to be far from the take profit, you can resort to manual averaging – this will bring the average price of the position closer to the current price level.

That is, either the averaging grid in the bot has wide gaps between order prices (and now the current price does not reach the next order for a long time, nor does it reach the Take profit). Either the grid had too small an overlap percentage, all its orders were executed, and the price went much further. Then we can add additional orders to the deal.

The averaging orders added to the deal do not affect the initial calculation of indents in the bot’s grid. When calculating indents, only the prices of orders from the initial bot setup are taken into account.

To best average the price, you will need to multiply the position volume (x2, x3, x5, etc.). Funds for averaging are taken from the free margin on the trading account, in excess of the deposit allocated to the bot. This is also why it is necessary to leave more funds in the supporting margin on the account – so that there is something to average in case of drawdown.

Example:

There is a long deal for 10 coins, the entry price is 4 USDT (we planned to sell for 5 USDT).

But the price has fallen and now ranges from 2 to 3 USDT per coin.

Then we create a purchase averaging order for 30 coins at 2 USDT. If the order is executed, our deal becomes 40 coins with an average price of 2.5 USDT. Therefore, our breakeven point turns out to be in the middle of the corridor, and we can close the deal without losses (or wait for a take profit, which will become much closer).

Reference:

The formula for averaging the price of a coin.

C = (K1 * C1 + K2 * C2) / (K1 + K2)

C is the price of the coin after averaging

K1 – the amount of coins in the first order

C1 – the price of the coin in the first order

K2 – the amount of coins to be purchased for averaging

C2 – the price of the coin when averaging

(10 * 4+30 * 2) / (10 + 30) = 100/40 = 2,5

There is a risk that after buying at 2 USDT, the price will not even reach 2.5, but will go even further from the desired one, and averaging will only worsen the problem – your free margin will decrease, the liquidation price will approach (in case of tradind Futures). Therefore, sometimes it is better to leave it as it is – and wait for the price reversal.

It is recommended to perform all averaging for deals that are in drawdown after a qualified analysis of the charts. For example, sometimes an averaging order can be placed in the support/resistance zone to which the price is moving, and they try to get the estimated new deal price so that it is reached after a rebound from the zone.

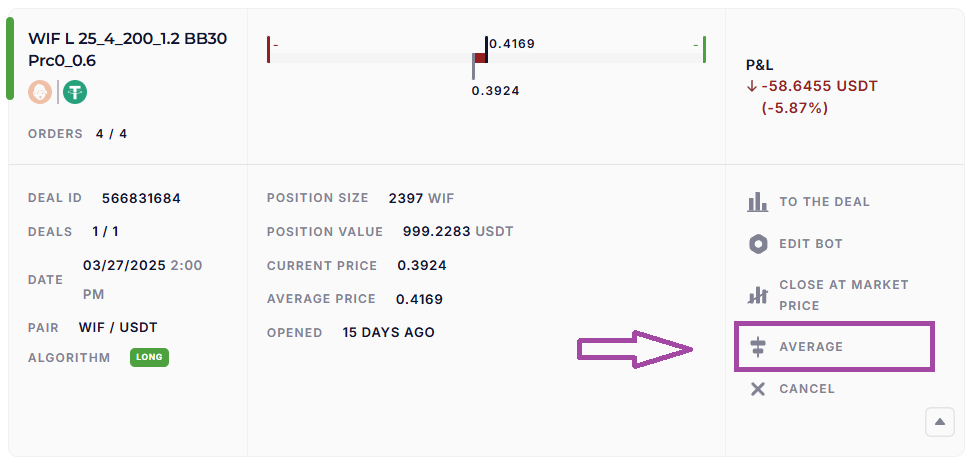

The “Average” button on the deals’ card (“Active Deals” page https://veles.finance/cabinet/deals) allows you to add an averaging order to the deal manually. The bot offers the price and quantity of the coin for the order according to its parameters – but it is recommended to set others values according to your analysis and calculations.

Note. The “Average” button disappears from the deals’ card if a Take Profit was executed in that deal. Find more information here:

https://help.veles.finance/en/active-deal-card/

Attention! If you set the order price higher the current price for the bot in Long (or below the current price for the bot in Short), such an order will be executed as a market order, immediately!

Be careful – it will be impossible to delete a wrong averaging order without stopping the bot with an error!

If the order is deleted on the exchange, the bot will get up with the error “Orders were deleted by the 3rd party”. If there is not enough free margin for the order, the bot will stop with the error “Insufficient balance”. If such a deal is restarted, the bot will restore the same order, since it has become part of this deal along with all grid orders, it will be shown on the Active Deal card in the list of orders.

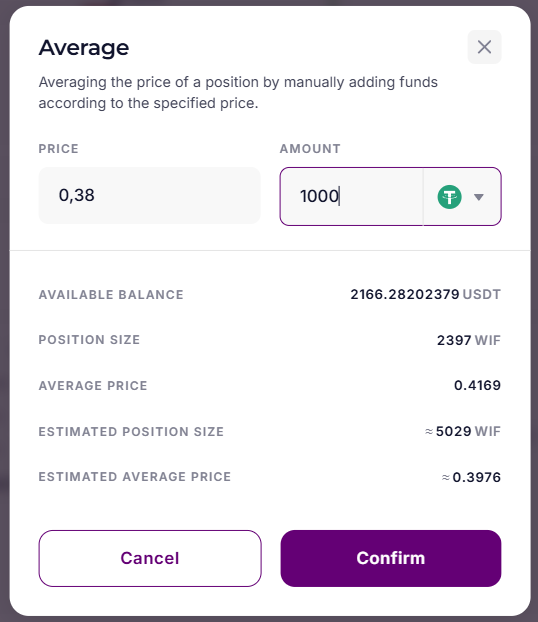

In the pop-up window, set the price at which the averaging order will be placed and choose the number of lots (coins of the base asset).

Important! If the order price is selected too far from the current price, the bot will add the order to the deal, but during placing the order on the exchange it may stop with the error “The order price does not meet the requirements”. In this situation, unfortunately, you must cancel the deal and complete it yourself according to the instructions in the article:

https://help.veles.finance/en/how-to-stop-the-bot-how-to-cancel-a-deal/

More information about bot errors:

https://help.veles.finance/en/types-of-bot-errors/

“Amount” indicates the volume of the order on the exchange. You can specify it in both coin and USDT. When you select the “USDT” option, your averaging order will be created within the specified amount and subject to the restrictions imposed by the exchange. To find out the amount of your own funds in the created order, divide the “Amount” by the leverage used in the bot.

In this example, the leverage of x10 is set in the bot, which means that 100 USDT of own funds from the balance of the exchange account will be involved in the order, and the supporting margin will decrease by this amount.

In the dialog box, you can also see the balance available on the exchange, the current position size and the current average price. The position size can serve as a guideline for determining the amount of coins in an averaging order – it makes sense to specify the same amount or more.

After specifying the order price and amount, study the estimated position size and estimated average price. Make sure that the price is within acceptable deviation from the current one (see the exchange’s documentation on the coin). If everything is fine, click “Confirm” – the order will be added to the deal and will appear in the list of orders.

Also read our article:

https://help.veles.finance/en/what-is-a-position-averaging/