A Stop Loss is a market order that is placed on the exchange for a specified percentage after the execution of the last order in the grid (after going beyond the % overlap).

For example, if you have an overlap of 10% and a Stop Loss of 2%, then this order will stand at a distance of 12% of the coin price at the time of opening a position.

The purpose of a Stop Loss is to close your deal at a loss if the price has already gone over the grid and your position is in danger of liquidation.

Important!

- If the ratio of the bot’s deposit and the supporting margin is not observed, liquidation may occur before the entire grid is executed and the Stop Loss is triggered.

- Do not confuse the percentage of drawdown on a position with a Stop Loss, these are different indicators in Veles bots.

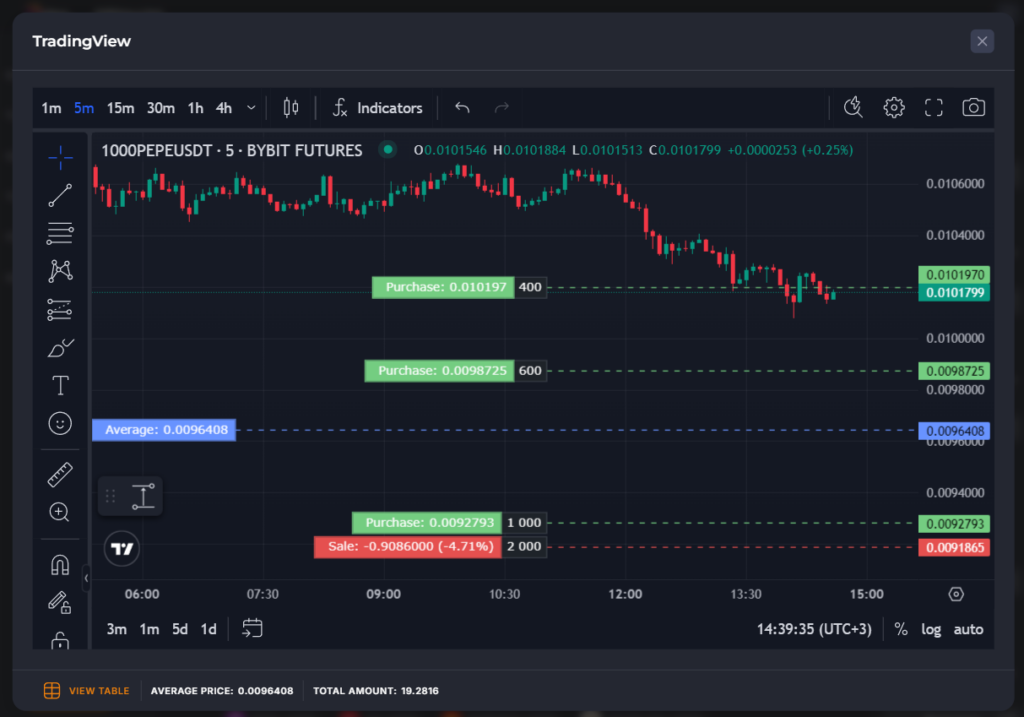

Since a Stop Loss order is a market order, it is not detected on the exchange until the order grid is fully executed. But the level of this order and the estimated sum of loss can be seen through the “View Grid” function in the bot editor (red dashed line).

The lowest “Sale” order in this example is a Stop Loss.

On our platform, Stop Loss is available on the Spot and Futures markets, on the Long and Short algorithms (however, Stop Loss is usually not used on the Spot, because it is preferable to average there).

Important!

- There is no support for stop marker orders on the Spot. This means that no order is placed on the exchange in advance. In the Active deal card, it will be calculated, recorded and marked, but it works on the Veles side – that is, your bot monitors when the price reaches the stop level or lower, and closes the position by the market order.

- On Bybit Futures, Binance Futures, BingX Futures, Bitget Futures, OKX Futures an intra-exchange trigger order is used, it is placed when the last order in the grid is created, it takes less than 1 second.

- On other exchanges, the Stop Loss is also logical – it is set by the bot based on the results of a regular check, if it satisfies the condition.

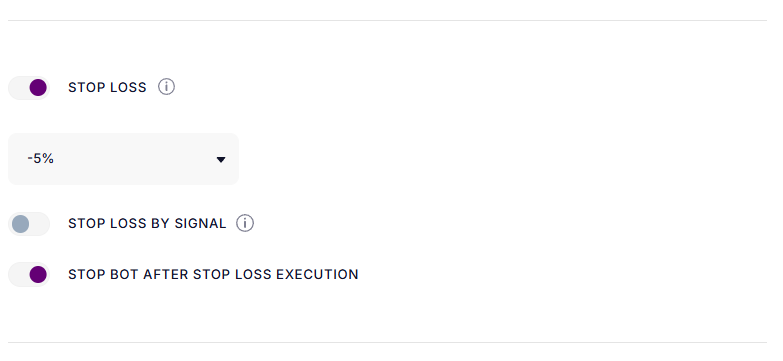

To use the Stop Loss, just go to the bot settings and enable the appropriate option.

Below specify at what distance in percentage from the last order in the grid the Stop Loss will be set.

For example, if the price of the last order is 100 and the stop loss percentage is 0.5, then the stop price is 100-0.5% = 99.5 for the Long algorithm and 100+0.5% = 100.5 for the Short algorithm.

You can (and you should) estimate the amount of loss by Stop Loss using backtests (the “Analysis” button in the bot editor) and on the “View Grid” chart (if you are using the simple trading mode).

Please remember that a Stop Loss order is a market order, and in the case of a fast price movement (squiz), it can give a greater loss than the calculation shows you!

If you have not set up a Stop Loss in the bot, and the bot has collected all grid orders (but not before), then you can set a stop loss for a position directly on the exchange (in the Positions section, column “TP/SL”). If such a Stop Loss works, you will record a loss on the position, the bot will stop with an error, but you can simply restart it.

You can also configure the bot to stop after a Stop Loss is executed.

Another option for a protective order is a Stop Loss based on the indicator signal:

https://help.veles.finance/en/stop-loss-by-indicator-signal/