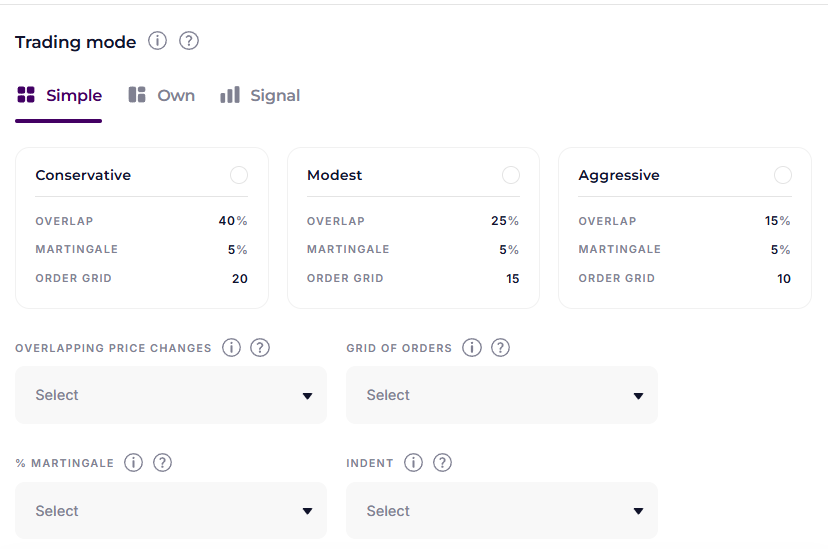

In this mode, you can see three ready-made grid options: Conservative, Modest and Aggressive. If the ready-made grid option does not suit you, the bot will automatically calculate the grid of orders (their margins and volumes) based on the Overlap, Grid of orders, Martingale, Indentation and Logarithmic distribution that you have selected.

Overlapping price changes – sets the percentage distance by which orders will be placed. The denser the overlap, the more aggressive the trade.

Grid of orders – divides the volume of the position by the set value and spreads it based on the overlap.

Martingale – reallocates the deposit between orders in such a way that each following order in the grid is larger in volume than the previous one by a set percentage:

https://help.veles.finance/en/how-does-the-martingale-strategy-work/

Indent – by setting the value of the parameter, the whole grid of orders will be placed above or below the set percentage of the current price. It is possible to select the “Market” value so that the order is executed at the market price:

https://help.veles.finance/en/how-does-the-pulling-up-the-order-grid-work/

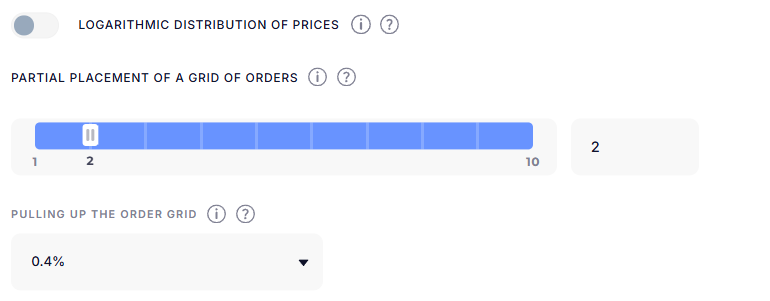

Logarithmic distribution of prices – the parameter edits the change of order density. If you set the value more than 1 – orders will be placed more densely to the start of the grid. Orders will be placed further away from the current price if you set the value less than 1.

https://help.veles.finance/en/how-does-orders-prices-logarithmic-distribution-work/

Partial placement of a grid of orders – allows you to use not the entire deposit at once, but only a specified number of orders.

Pulling up the order grid– cancels the grid if the price moves to the other side by a specified percentage. In this case, the bot will search for a new entrance point:

https://help.veles.finance/en/how-does-the-pulling-up-the-order-grid-work/

After each grid change, use the View grid tool to visually assess how your new grid will overlap with the coin graph.

The next trading mode option is “Own”:

https://help.veles.finance/en/trading-mode-own/

A full list of bot settings and parameters can be found in the article:

https://help.veles.finance/en/how-to-create-and-edit-a-bot-full-list-of-bot-settings/