Filters or indicators are parameters by which you can set the conditions for opening, averaging or closing a deal. There are many indicators in technical analysis, and new ones appear periodically. Each indicator is calculated according to its own formula based on historical data (price charts for a coin, or for another traded asset taken from the exchange). The set of available filters on the platform Veles is constantly expanding.

Using filters, you can search for oversold/overbought points of an asset, determine the intersection of levels or channel boundaries, track the price itself or its change, trading volumes, and so on.

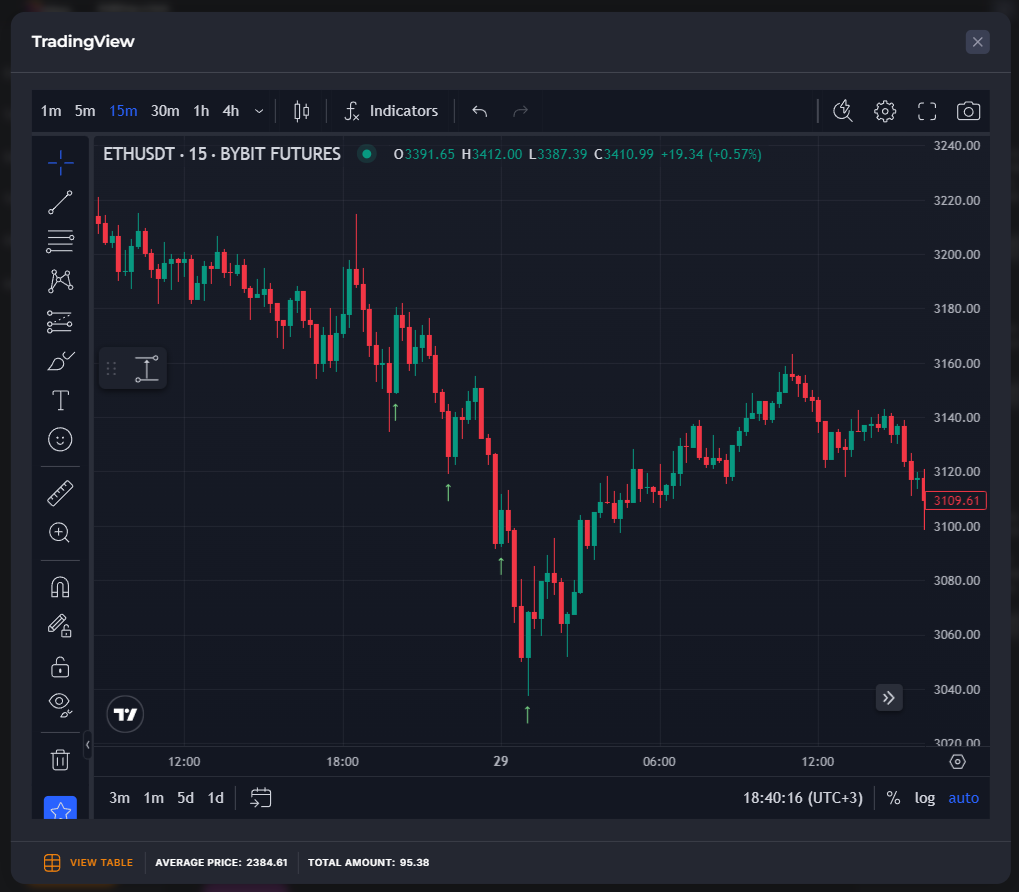

For example, if you configure the bot to open a trade using the channel indicator “Bollinger Bands” on a 1-hour timeframe, then potential entries for the Long deal will be at these local lows (on candlesticks with green arrows):

Ready sets of filters

If you don’t know where to start, you can use ready-made filter templates – Conservative, Modest, Aggressive. A preconfigured set of indicators will be added to the bot, and all of them have to match in order to allow the bot open a deal.

Help for different filters is available in the bot editor by clicking the “?” button.

Bot with no start filters

Now it is possible to create a bot that does not use any filters at the start. Such a bot enters into a new deal immediately after the old one is closed. But this is very risky, and is not recommended for beginners.

Choosing the best entry point to a deal (that is, not using a bot without filters, or with a filter like “Price is greater than 0”, and also not sending a bot to a deal forcibly because you are tired of waiting) is very important. If the bot opens a position at the point of extreme price deviation from its usual range (a long position at the very peak of the pump, for example), then for effective averaging and achieving profit, it will need a very large overlap and such an amount of funds that usually no one plans to give the bot as a deposit. It is good if the balance allows you to survive the investment and does not liquidate you (in the case of futures). But it will also be unpleasant – lost time, frozen funds, funding. You can put a stop loss in the bot, but it can also be painful. It is easier to choose filters that will at least cut off such situations. It is impossible to predict the market decline with indicators, but it is possible to prevent the opening of a deal at the tops, for example.

How multiple filters are processed

If several indicators are configured, the bot will check all the installed indicators if one of them indicates an entry point.

The order in which the indicators are displayed in the bot editor does not matter, the check goes from the older timeframes to the younger ones.

Example:

At 13:00, the bot receives a signal from the TF indicator for 1 hour, but the indicator for 5 minutes did not give an entry point .

After that the indicator with TF 1 hour will “light up” (allow entry) all the time from 13:00 to 14:00.

On the candle from 13:20 to 13:25, the bot receives a signal from the indicator with a TF of 5 minutes. Therefore, the bot will check that there is a signal at both 1 hour and 5 minutes, and at 13:25 it will open the deal.

Calculation methods

Two different methods of calculating indicators are available on the platform. The choice of the calculation option depends solely on your preferences.

“At the bar close” is based on the closed candles. Thus, as soon as the candle with the selected timeframe closes with the fulfillment of the condition, after receiving the signal, the bot will enter only on the next candle after closing the previous one.

“Once per minute” is a method we used before. That is, in one candle (if it is more than 1 minute timeframe), the bot could get more then one entry signal.

At the same time, on some filters, such as CCI, this can give a lot of false signals.

For example, if you set the CCI to a timeframe of 1 hour and the calculation type is “Once per minute”, then the results within this hour can change to the exact opposite (from -100 to +100).

Attention! Due to the mentioned feature of the “Once per minute” calculation method, our support does not consider requests for bots that use it. Since it is technically impossible to track and reproduce the indicator readings for debugging.

However, there are also filters that are good for calculating once per minute (mainly the channel ones): Bollinger Bands, Keltner channel, % of price change, etc.