ATR (Average True Range) is a technical indicator that measures the volatility of a coin. It determines the average of the largest price spread over a certain period of time.

The indicator is a useful tool for intraday trading. However, if you apply it on larger timeframes, you can identify the long-term interest of market participants in a certain asset.

Typically, volatility increases during price reversals, breakdown of support or resistance levels, as well as during exchange listings.

Determine the values using the indicator overlay in the TradingView chart in Preview mode.

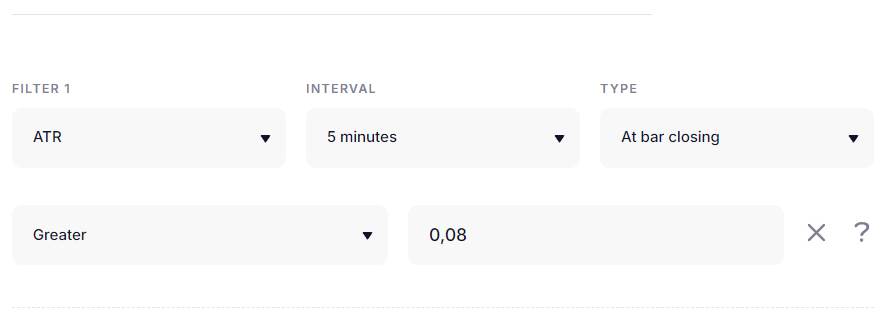

To start the bot to work with volatility, select ATR in the filters and set the timeframe and value.

Click on the “Pencil” button to set the values you need for the indicator.

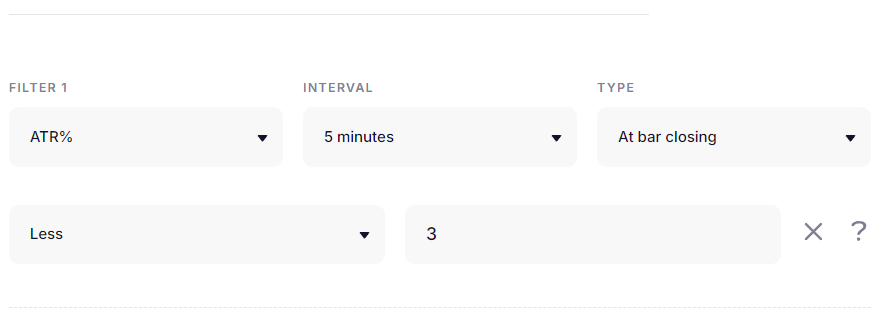

ATR% shows the percentage of volatility where 100% is the maximum possible volatility of the asset.

To start the bot to work with volatility, select ATR% in the filters and set the timeframe and percent value. Click on the “Pencil” button to set the values you need for the indicator.

On lower timeframes, this indicator will take values up to 3% in most cases, on higher timeframes the values may be higher. It is also necessary to take into account the average current volatility of the asset, it varies from coin to coin and may change over time.

For example, the following classification of values can be proposed for Bitcoin:

| Timeframe | Low Volatility | Moderate Volatility | High Volatility | Extreme Volatility |

| M1-M15 | < 0.5% | 0.5% – 2% | >2% | Rare |

| H1 | < 1% | 1% – 3% | > 3% | Rare |

| H4 | < 2% | 2% – 5% | > 5% | > 10% |

| D1 | < 3% | 3% – 7% | > 7% | > 10% |

| W1 | < 5% | 5% – 10% | > 10% | > 15% |

| MN | < 10% | 10% – 20% | > 20% | > 30% |

Based on these data, we select the indicator values for our strategy. That is, if we want the bot to open trades only in a relatively flat market, we set up a combination of indicators:

“ATR%, 1 minute, at the close of the bar, less, 2%”

“ATR%, 5 minutes, at the close of the bar, less, 2%”

“ATR%, 15 minutes, at the closing of the bar, less, 3%”

“ATR%, 30 minutes, at the closing of the bar, less, 3%”

“ATR%, 1 hour, at the closing of the bar, less, 3%”