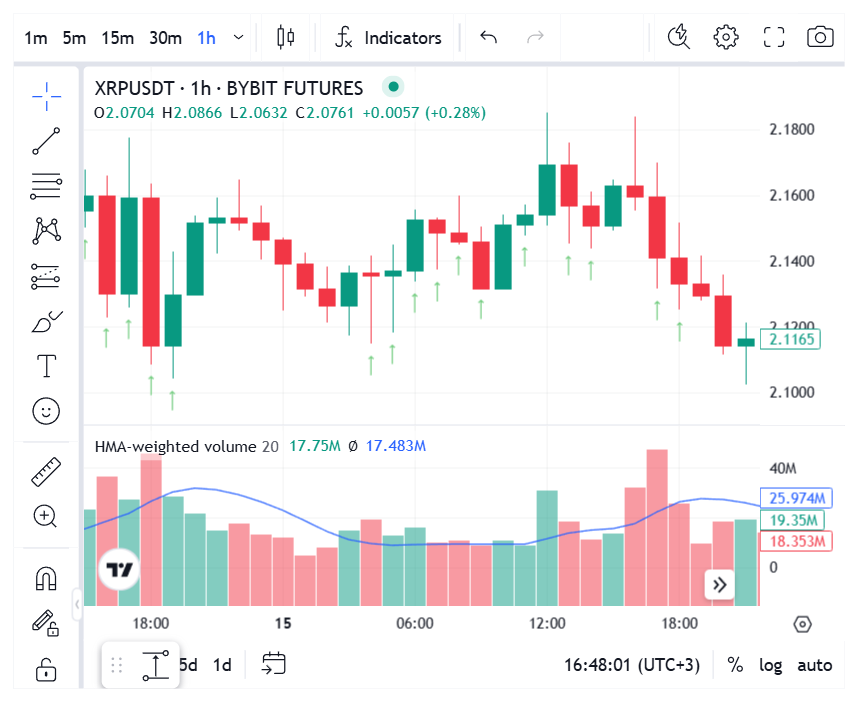

The “Hull Moving Average Weighted Volume” is a comparison of the current trading volume with its average value calculated using the Hull Moving Average (HMA). This indicator allows you to identify phases of increased or decreased activity in the market and filter out “false” movements, confirming the strength of the trend.

The principle of operation:

- The Hull Moving Average (HMA) is calculated for volumes over a given period of time.

- The signals are generated based on comparing the current volume with the HMAX value.

The indicator gives the following signals:

Open deal in Long (or close Short) – when the current volume is above the moving average.

Open deal in Short (or close Long) – when the current volume is below the moving average.

This approach assumes that an impulse is needed to open Long deal (increased activity), and a phase of fading interest (decrease in volume) is needed to open Short deals.

When the “Reverse signal” mode is activated, the signal to open Short will be given at increased volumes, and a signal to open Long – when volumes are below their average value. It can be useful for strategies focused on trading in Short on momentum:

It is recommended to combine this indicator with others (for example, RSI or MACD), that is, to use it to filter signals based on market activity.